LGIS works with over 20 indemnity partners to ensure that members are well supported and protected across a diverse range of exposures. This reflects the increasing complexity of the sector and the variety of operational areas and responsibilities it covers. Many of the day-to-day business activities of members carry potential for major claims and both reinsurers and the Scheme have their eye on emerging factors.

Bushfires – approvals and management

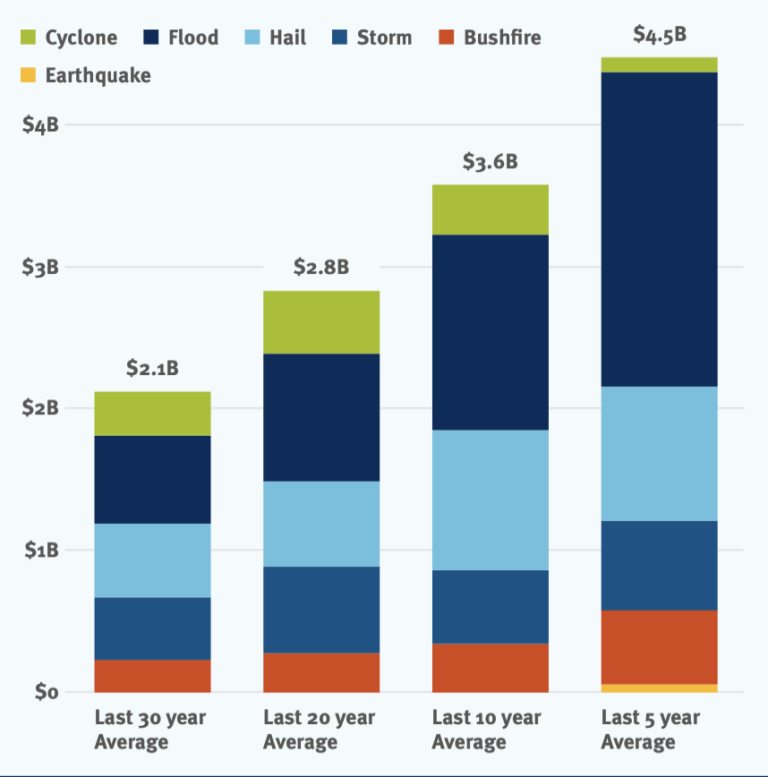

Australia is known for its bushfires and our global partners have a keen interest in this area. In recent years there have been a couple of WA local government claims which have put preventative bushfire functions and tree management in the spotlight. To date the number of claims has been small but the potential cost has been significant.

Global bushfire activity is also forefront in the minds of indemnity partners. The recent LA fires and their outcomes will undoubtedly be a focal point, especially concerning land use planning, preparation and emergency response.

Abuse claims and protection for vulnerable people

The landscape for historical abuse claims, particularly those involving children, is on the radar and members may see changes to limit constraints and/or exclusions.

Cover for abuse is not available at the limits required and any offerings available are restrictive and limited to defence costs only. The exposure for these types of claims is long tail and was a key reason for the winding-up of Catholic Church Insurance back 2023.

LGIS’s Indemnity partners have shown a desire to restrict coverage over the past decade, and while the Scheme has resisted changes thus far, they are likely to be implemented soon. It’s essential that members address any issues related to mitigation, policy, and procedure, as well as the implementation of Royal Commission recommendations.

Work, health and safety – particularly contractor management It’s been five years since the Work Health and Safety Act 2020 (WA) (WHS) was adopted and it’s now being tested in the West Australian court system. There are several incident investigations which are ongoing and will be turning points to provide clarity on local government responsibilities. Interpretation of WHS duties and obligations regarding volunteer bushfire fighters is high on the watchlist. Another area of interest is the sector’s labour hire contract practices to meet WHS duties and obligations to deliver a safe work environment. Again, there are several incidents under WorkSafe WA investigation which will provide clarity. Indemnity partners and the Scheme are looking to members to adopt policies and procedures alongside thorough documentation to demonstrate that they are making reasonable efforts to meet their duty of care in this area.

PFAS – Forever chemicals

PFAS or Per- and poly-fluoroalkyl substances is an emerging issue for indemnity partners. They are considering the broad exposure to governments at all levels and working to understand the specific situation for local government in Australia.

PFAS are a diverse group of synthetically produced chemicals resistant to heat, water and oils. They were used in common household and industrial products in the 1950s and in firefighting foams from the 1970s. PFAS are persistent and highly resistant to physical, chemical and biological degradation. Consequently, PFAS are found in humans, animals, and the environment around Australia.

Addressing the wide range of issues associated with PFAS contamination, including the management of PFAS contaminated materials, represents a challenge for all levels of government as environmental regulators.

There is plenty that is unknown about PFAS, their long-term effect and potential for liability. At this time, the WA local government sector’s exposure is minimal, but it is an area that will remain in the spotlight in coming years as it develops. Members involved in waste management or bushfire response should give PFAS consideration.

Nuclear verdicts and class actions An issue primarily coming out of the United States, class actions and nuclear verdicts have global indemnity partners on watch. In 2023, 89 USA lawsuits against corporate defendants resulted in a ‘nuclear verdict’ award, a 15-year high. Nuclear jury verdicts are those that surpass $10 million and have been increasing in the States by both size and number since 2009. In 2023 the number of these cases increased by 27% with the median award rising to $44 million. In Australia we have not seen nuclear verdicts emerge, but class actions are on the rise. According to Herbert Smith Freehills, outside of the USA Australia is the preferred jurisdiction to file a class action for those that promote them. In 2023 approximately one class action was filed every week in Australia. The sectors identified to be most at risk include finance and insurance, plus healthcare, government, manufacturing, infrastructure, and technology. While there is no indication of nuclear verdicts in Australia, indemnity partners are keeping an eye on the national trend which has demonstrated a tendency to follow American patterns with regard to class actions.