Welcome to the board

LGIS WA has a new board member in Claremont councillor Paul Kelly.

Cr Kelly brings a wealth of knowledge to the role – with previous experience as board member and chairperson of the board at LGIS.

Globally, every organisation has been hit by the pandemic and the resulting economic fallout – from local governments here in WA to the world’s insurance market.

The world of insurance has changed rapidly.

The insurance market has been hardening for the past two years. Globally, the market is undergoing challenges, driven by the increasing cost of natural catastrophes, poor performance of professional indemnity and directors and officer markets (councillors and officers [C&O] in local government parlance).

Catastrophic events like cyclones, storms, bushfires and systemic issues around building professionals and governance are putting added pressure on insurers. Significant losses mean many insurers are paying more in claims than they have received in premiums.

LGIS WA has a new board member in Claremont councillor Paul Kelly.

Cr Kelly brings a wealth of knowledge to the role – with previous experience as board member and chairperson of the board at LGIS.

As we look to the recovery phase of the current crisis, our focus in still on our people and integrating them successfully back to a new work environment.

According to the Australian Bureau of Statistics, nearly half of all Australians were working from home at the start of May.

Many local government employees found they were also either working from home, stood down or redeployed into different departments.

The general insurance industry suffered a 34.9 per cent decline in underwriting profit – squeezed by claims losses from recent environmental disasters. In early 2020, The Insurance Council of Australia estimated the claims totals from last summer’s bushfires and hailstorm events would both reach $3 billion, the latest numbers put the cost at nearly $5.19b. It’s expected the most recent storms will add another $270 million lodged in the past four weeks.

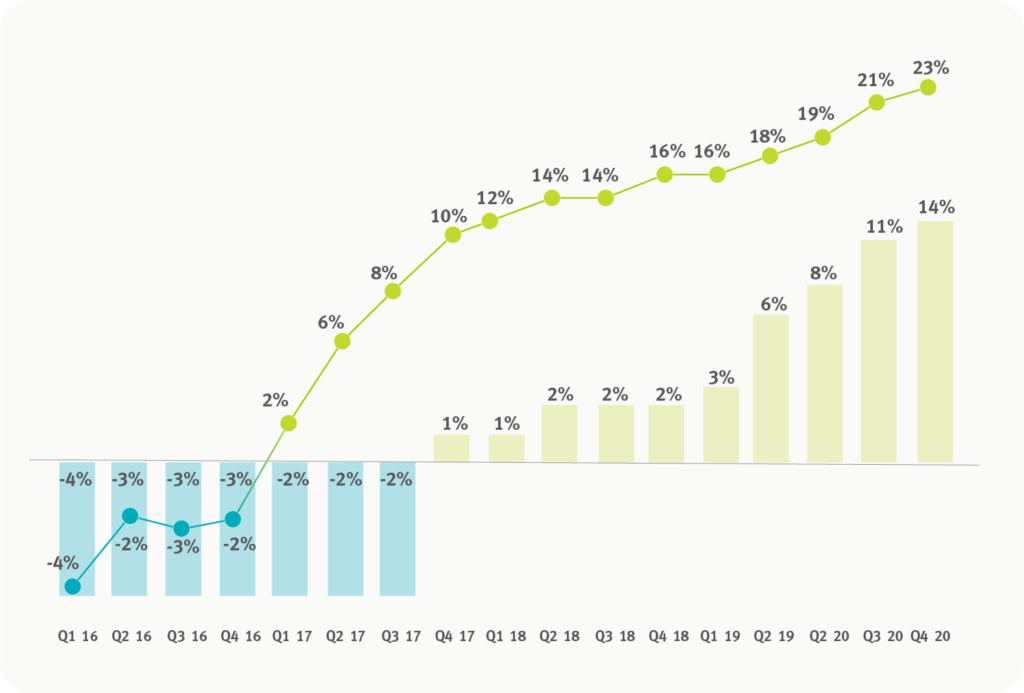

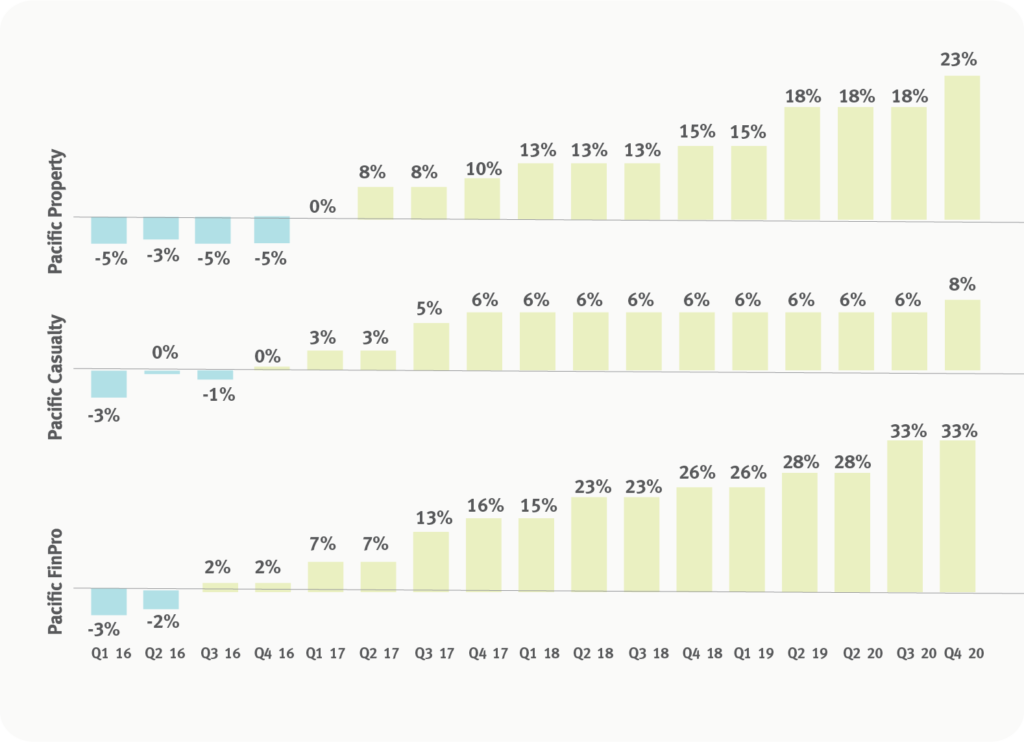

Resultant price increases are driven principally by increases in property, insurance and financial, and professional lines according to Marsh’s quarterly Global Insurance Market Index. This is a proprietary measure of global commercial insurance premium pricing change at renewal, representing the world’s major insurance markets and making up nearly 90 per cent of Marsh’s premium.

Apart from pricing pressure, there has been a rapid decrease in the amount of money insurers are willing to risk, due to:

These changes come prior to the impact of the COVID-19 global pandemic. Significant pricing increases and tightening of terms and conditions are likely continue throughout 2020 and well into 2023, but how does this affect your Scheme?

Since its inception, the Scheme has innovated to ensure the continued, sustainable protection of the WA local government sector, often taking on risk and providing covers when the commercial market has no appetite.

The tradition of innovation continues and LGIS has analysed market trends to identify areas where the sector will need greater certainty and sustainability going forward. That’s why in 2017 LGIS began to consider more Scheme protections, such as pollution legal liability, and consulted widely across the sector. In 2019, the WALGA State Council provided further direction to broaden the Scheme.

The Scheme, under the direction of WALGA State Council have decided effective June 30, 2020 to include protection coverage not currently in the Scheme (See table below).

The reasoning behind State Council’s decision was twofold, firstly to create greater clarity in the role of the Scheme, and WALGA as its trustee. The second recognised the Scheme’s success in providing affordable, sustainable cover for the sector, acknowledging that the commercial insurance market would continue to fluctuate (but never anticipating the impact of the pandemic). Broadening the Scheme’s protection insulates the sector against this volatility.

While, LGIS is not immune to the large losses suffered by insurers, its scale and risk based approach provide it with a stronger negotiating arm. LGIS committed to the sustainable protection of the sector but concerted efforts were made to limit contribution volatility by providing relevant risk management support.

For seven out of ten years, economic costs of natural disasters have exceeded the 30-year average. The amount of extreme weather events have tripled globally since the 1980s.

Catastrophic events like cyclones, floods, storms, bushfires and earthquakes are putting added pressure on insurers to understand accumulation risks (number of risks in a geographical location exposed to hazards).

Commercial property insurance pricing increased 23 per cent in the quarter, the tenth consecutive quarter of year-on-year double-digit increases. Property increases were driven by bushfires, hailstorm damage, and flooding in December and January. More than 30 per cent in increases were reported for clients located in cyclone, storm and earthquake exposed locations.

There is increased focus on:

This has been one of the most challenging renewals and while the Scheme has cushioned the market dynamics, the following changes are advised for the membership year of 20/21:

Commercial pricing has been increasing for three years despite increased competition and has seen on average an 8 per cent increase (and 30 per cent for professional indemnity), however some types of exposure receive increases ranging from 10 per cent to 20 per cent.

Climate change factors have increasing impact upon reinsurer attitudes in providing cover in many areas, including risks facing specific exposures to bushfire and flood.

Decisions around pricing include the evolving claims environment (such as recent class-action claims and settlements arising from bushfires across Australia) and extends to losses incurred unrelated to Australia, such as the Californian wildfires where the same reinsurers will typically be exposed.

Many insurers are more selective of the risks that they are choosing to write, preferring to decline a risk entirely if it falls outside of their underwriting appetite, as opposed to chasing market share.

The Building Surveyor and Certification crisis has been largely muted in recent media but this area of risk continues to deteriorate with private certifiers scrambling to find alternative providers as insurers withdraw from the market. If there is pressure for local governments to carry more of this burden, changing the risk profile of the sector would invariable impact coverage (were it still offered) and at what price.

Did you know?

The Australian insurance market is driven by both the local market and Lloyd’s of London. Lloyd’s is not an insurance company but a market where syndicates join to form the world’s largest insurance market. Australia is the fourth largest market for Lloyd’s and the Australian professional indemnity (PI) market is directly connected to the UK market. Market trends in the UK often directly impact the Australian market.

Workers Compensation is fully self-management and pricing is subject to members claims outcomes.

The integrated end-to-end management of workers’ compensation claims continues to yield positive results for the sector.

We are continuing to experience:

Marginal increases, reflective of salary movements and individual member claims performance is expected.

The recent review of bushfire deaths in Australia, between 2010-2020, found 65 deaths have occurred in Australia from 2010 to 2020 due to bushfires.

More than half the deaths (35) occurred during 2020.

Up until recently, volunteers only received minor injuries. Recently we received more traumatic injury and illness claims (e.g. cancer).

Reinsurance renewals have been challenging given the limited pool of local reinsurers prepared to write this business.

We limited a potential 30-50 per cent increase in reinsurance costs by reviewing the Scheme’s ability to retain more claims risk, increasing the retention to $750,000.

Similar to property, the motor reinsurance environment has sustained ongoing pressure on claim costs but overall members will see marginal growth in costs.

The Motor Fleet and Management Liability (C&O) protection policies provide the Scheme with a great opportunity to improve the member engagement and experience.

Increasing claims due to regulatory investigations, employment practices failing and highly combative stakeholders raised concerns. Councillors and Officers (C&O), specific to WA local government, was under significant pressure due to recent adverse claim trends.

More broadly, other factors such as shareholder activism and rising cybersecurity risks are expected to continue to pose challenges to C&O underwriters as losses creep from employment liabilities practices and cyber to C&O – creating clash potential. While these claims aren’t coming from the public sector, pricing for the sector is contaminated due to claims (class actions and securities claims) against listed companies.

As we continue our phased approach to expanding the Scheme we will look to harness the benefits of scale and apply better structures to create more market resistant products. This is an exciting step towards a fully integrated offering.

With the changing market sentiment thanks to the current loss environment, there have also been shifting views of risk.

The success of the Scheme enables LGIS to be proactive in managing risk and offer a range of risk management and mitigation services to all members. These risk services drive down the number of claims and respond quickly to the changing risk profile of the local government sector.

WA local governments are faced with evolving challenges and risks every year from climate change, coastal erosion, liability exposures and increasing psychological injury claims. In recent months, we’ve seen how a single event can have a rolling impact on the sector with the Cleanaway processing plant fire, and we’ve witnessed the fallout from CCC and State Government investigations into councillor and employee conduct.

Many of these risks are foreseeable and mitigation strategies can be put in place to reduce their impact, or potentially remove the risk altogether.

At LGIS, we specialise in WA local government risk and we understand the complexity of the sector like no other. We know that protection is as much about reducing risk as it is about cover. We work together with members to manage risks and drive down claims – this protects the Scheme, contains contribution costs, and ensures the sustainable protection of the sector.

It’s vital to the protection of your Scheme and the whole of the sector that every member has access to evidence based and appropriate risk services. This is why we delivered more than 20,000 hours of risk consulting to members as part of the Scheme risk program in 2019.

Every three years we review our risk program, which is provided to all Scheme members, ensuring we’re delivering services which protect your Scheme and meet the changing needs of the sector. In February, the LGIS Board of Directors endorsed the next three-year program. This provides members with the range of high quality risk services they have come to expect as part of their Scheme membership and introduces new initiatives to meet the sectors’ evolving risk profile.

I just want insurance cover. Why do I need risk management too?

Consider this: You buy a home in a suburb with a high crime rate. You can put locks on doors and windows, and install cameras and alarms as an added layer of protection. Or you could go without and deal with the consequences of theft and crime. Sure, your insurance will cover any property damage or theft, but your premiums will go up and you’ll be left waiting for repairs or compensation to come through. The risk management services offered through the Scheme act like the security on your house. It’s an added layer of protection to safeguard your buildings, staff members and community from risks, as well as your local government.

These new projects and services are added to the extensive suite of Scheme risk services which are included as part of membership.

In 2020, LGIS will continue to deliver services on key areas including:

The Health and Wellbeing program will also continue providing members with access to a variety of services that support the health of their workforce including:

Commercial insurers have not been able to match comprehensive cover provided by LGIS, which has been developed over years and reflects the complexity of local government. The LGIS model reduces the impact of volatility from claims or peaks and troughs driven by traditional insurance cycles. The expansion of the Scheme provides members with greater stability across a wider range of exposures, thus ensuring the total cost of risk is at a competitive level over the long-term, and capital reserves insulate against any sudden or dramatic withdrawal in the insurance or reinsurance market.

For more information on the current market trends and how it may affect your local government, contact your Member Services Account Manager.

Western Australia fared better than many locations around the world following the coronavirus pandemic. However, COVID-19 had an overwhelming impact on local governments and exposed weaknesses within every industry.

How local governments operate in a post COVID-19 world will determine future workplace success.

Ideally, local governments will exit the crisis better than before.

As local governments prepare for the new normal of physical health safe guards including temperature checks and additional cleaning, they also need to consider how best to monitor and support employees mental health.

Following COVID lockdowns expect people to flock to outdoor areas and other local government facilities. Prior to opening these public spaces as part of Phase 3, local governments should make sure they are ready to be used.

LGIS is the unifying name for the dedicated suite of risk financing and management services for WA local governments, established by the WA Local Government Association in conjunction with JLT Public Sector (part of the Marsh group of companies). LGIS is managed by JLT Public Sector (ABN 69 009 098 864 AFS Licence 226827).

Risk Matters, via this website, is designed to keep members, their staff and elected members informed on topical risk management and insurance issues and LGIS programs and services.